Published by Joe Webster

Last updated Jan, 20 2026

U.S. Moving Volume Breakdown

Residential vs Commercial Moves

Each year, relocation activity in the United States involves tens of millions of residential and commercial moves, forming one of the largest recurring logistical markets in the country. The data below reflects the most recently available national mobility and relocation statistics.

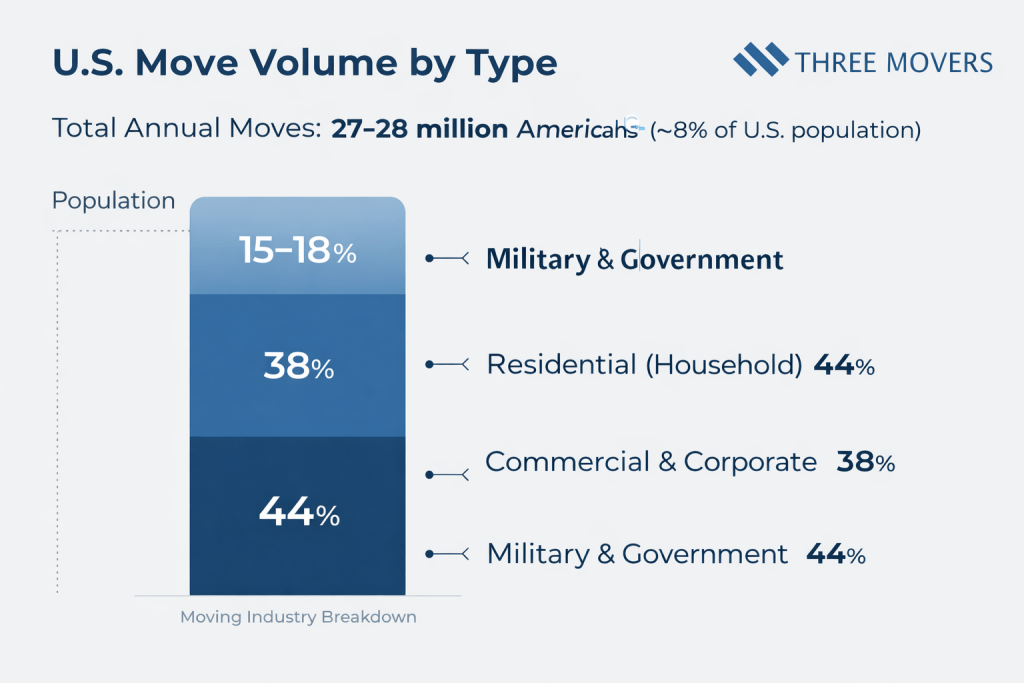

Total Annual Moving Volume (U.S.)

- 27–28 million Americans move each year

- This represents approximately 8–9% of the total U.S. population

- U.S. mobility rates are at historic lows compared to the 1980s but have stabilized since 2021

Share of Moves by Type

- Residential (household) moves: ~44% of all U.S. relocations

- Commercial & corporate moves: ~38% of all relocations

- Military & government moves: ~15–18% annually

Residential Moving Volume

Residential moves account for the largest share of total relocations by volume. These include:

- Apartment and rental moves

- Homebuyer relocations

- Intra-city and intrastate household moves

Most residential moves occur within the same county or state, driven by housing changes, family needs, and employment shifts.

Commercial & Corporate Moving Volume

Commercial moves represent a smaller number of total moves but involve higher logistical complexity. This category includes:

- Employer-sponsored employee relocations

- Office and headquarters moves

- Business expansions, consolidations, and downsizing

While only a small percentage of U.S. businesses relocate each year, corporate moves account for a disproportionately high share of industry revenue and planning demand.

Military & Government Relocations

Military and government-related moves form a stable baseline of annual relocation activity, occurring independently of housing cycles or economic conditions. These moves follow fixed schedules and contribute consistent demand to the moving industry.

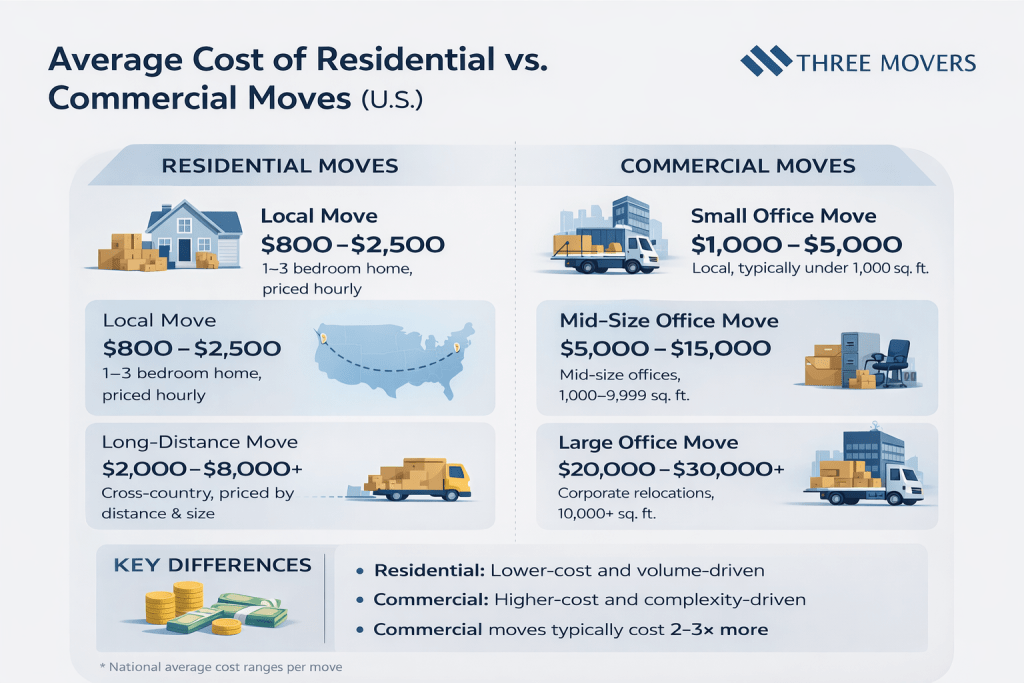

Average Cost of Residential vs Commercial Moves (U.S.)

Moving costs in the United States vary significantly depending on whether a move is residential or commercial. While residential moves are driven largely by home size and distance, commercial relocations involve additional operational, labor, and downtime considerations that materially increase total cost.

The figures below reflect national average cost ranges based on aggregated industry pricing data and recent mover cost studies.

Average Residential Moving Costs

Residential moving costs are typically lower and more standardized, especially for local moves.

- Local residential moves:

$800–$2,500 on average

(Most commonly for 1–3 bedroom homes, priced hourly) - Long-distance residential moves:

$2,000–$8,000+ depending on distance and home size

(Cross-country household moves frequently exceed $6,000)

Residential pricing is primarily influenced by:

- Home size and inventory volume

- Distance traveled

- Packing services

- Stairs, elevators, and access conditions

Average Commercial Moving Costs

Commercial moves carry substantially higher costs due to complexity, coordination, and labor requirements.

- Small office moves (local):

$1,000–$5,000 - Mid-size office moves:

$5,000–$15,000 - Large office or corporate relocations:

$20,000–$30,000+

Commercial moving costs are commonly calculated using:

- Square footage or number of workstations

- Specialized equipment handling (IT, servers, machinery)

- After-hours or weekend scheduling

- Project management and coordination time

As a result, commercial relocations often cost 2–3× more than comparable residential moves of similar physical size.

Cost Comparison Takeaway

- Residential moves are lower-cost and volume-driven

- Commercial moves are higher-cost and complexity-driven

- Commercial relocations represent a disproportionate share of moving industry revenue relative to their frequency

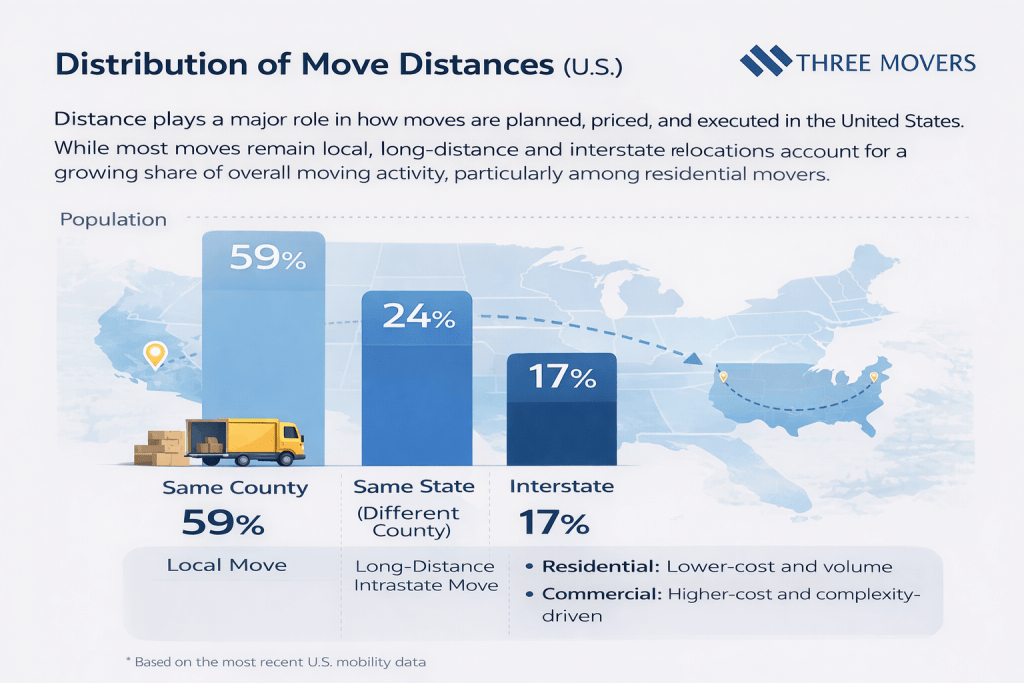

Move Distance Patterns & Interstate Trends (U.S.)

Distance plays a major role in how moves are planned, priced, and executed in the United States. While most moves remain local, long-distance and interstate relocations account for a growing share of overall moving activity, particularly among residential movers.

The data below reflects national migration and relocation patterns based on the most recent publicly available U.S. mobility datasets.

Local vs Long-Distance Moving Trends

- Approximately 59–60% of U.S. moves occur within the same county

- About 24–25% of movers relocate to a different county within the same state

- Roughly 15–20% of all moves are interstate

This means nearly 4 out of 5 moves remain intrastate, while interstate relocations represent a smaller but economically significant segment of the moving market.

Residential Distance Patterns

Residential movers are more likely to make long-distance and interstate moves than businesses.

Key residential trends include:

- Interstate residential moves have reached their highest share in over two decades

- More than 8 million Americans move to a different state each year

- Long-distance moves are increasingly driven by:

- Job flexibility and remote work

- Housing affordability differences between states

- Lifestyle and retirement relocation

Despite this growth, local residential moves still dominate by volume, particularly among renters and urban households.

Commercial Distance Patterns

Commercial and corporate relocations follow a different distance profile.

- Most business moves occur within the same metro area or state

- Interstate business relocations remain relatively rare

- Fewer than 1% of U.S. businesses relocate across state lines in a given year

When commercial moves do cross state lines, they are typically:

- Headquarters relocations

- Major expansions or consolidations

- Tax or cost-driven strategic moves

These moves, while infrequent, tend to involve large project scopes and higher per-move costs.

Distance Trend Takeaway

- Residential movers are driving growth in interstate moves

- Commercial moves remain primarily local or regional

- Interstate relocations account for a minority of total moves but a majority of long-distance revenue

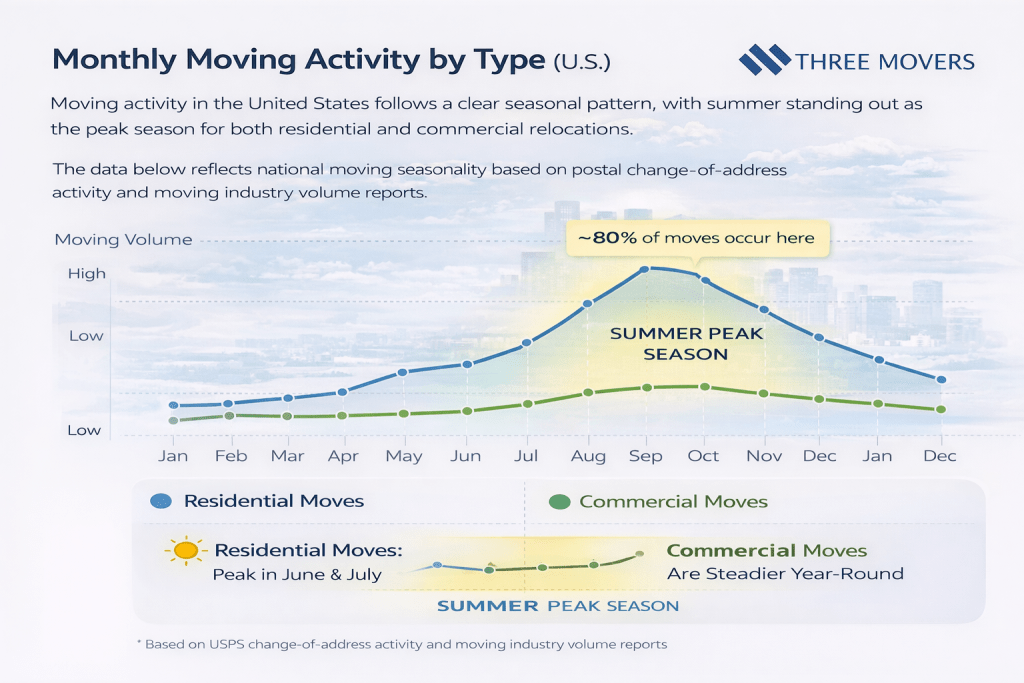

Seasonal Moving Trends in the U.S.

Residential vs Commercial Timing

Moving activity in the United States follows a highly predictable seasonal pattern. While both residential and commercial moves increase during warmer months, the timing drivers behind each differ.

The data below reflects national moving seasonality based on postal change-of-address activity and moving industry volume reports.

Peak Moving Months (All Move Types)

- Approximately 70–80% of all U.S. moves occur between April and September

- June and July are consistently the busiest moving months

- June 1 and June 30 are among the highest-volume moving days each year

During peak season, mover availability tightens and pricing reaches its annual highs due to demand concentration.

Residential Moving Seasonality

Residential moves are most heavily influenced by:

- School calendars

- Housing market cycles

- Weather conditions

Key residential trends:

- Residential moving volume peaks between May and August

- Summer accounts for the majority of household relocations

- Winter months (November–February) see the lowest residential move activity

This seasonality is especially pronounced for families with children and long-distance household moves.

Commercial Moving Seasonality

Commercial and corporate moves follow a slightly different pattern:

- Many business relocations are scheduled outside of core business hours

- Commercial moves often align with:

- Fiscal quarters

- Lease expirations

- Office buildout timelines

While summer remains the busiest period overall, some businesses intentionally move during off-peak months to:

- Reduce costs

- Improve mover availability

- Minimize operational disruption

Seasonality Takeaway

- Summer dominates U.S. moving activity across both segments

- Residential seasonality is sharper and more concentrated

- Commercial moves show greater scheduling flexibility

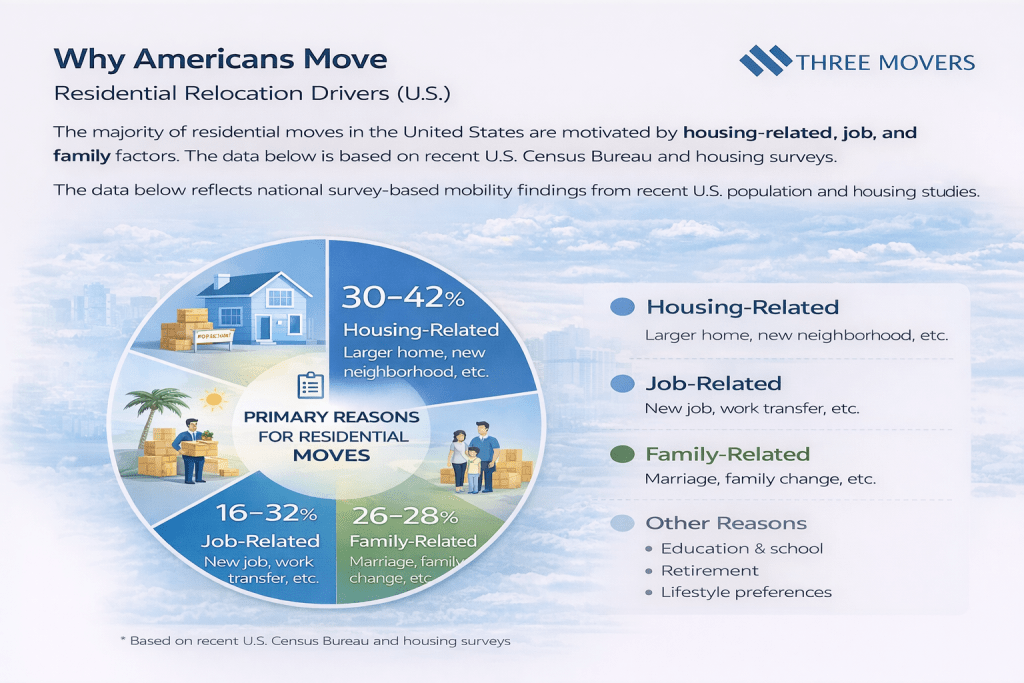

Why Americans Move

Residential Relocation Drivers (U.S.)

Residential moving decisions in the United States are driven primarily by housing needs, employment changes, and family-related factors. While economic conditions influence mobility, household relocation reasons have remained relatively consistent over time.

The data below reflects national survey-based mobility findings from recent U.S. population and housing studies.

Primary Reasons for Residential Moves

- Housing-related reasons: 30–42% of all residential moves

(Seeking a larger home, better condition, lower costs, or homeownership) - Job or employment-related reasons: 16–32%

(New jobs, transfers, shorter commutes, or remote work flexibility) - Family-related reasons: 26–28%

(Marriage, divorce, moving closer to family members)

These three categories account for the vast majority of residential relocations nationwide.

Secondary Residential Moving Drivers

Smaller but notable portions of residential moves are driven by:

- Education-related moves (college and graduate school)

- Retirement relocations, including climate- and cost-driven moves

- Lifestyle and location preferences, such as:

- Lower cost of living

- Climate considerations

- State tax differences

In recent years, flexibility in remote and hybrid work has increased the share of moves motivated by non-employment lifestyle factors, even when job location remains unchanged.

Residential Moving Takeaway

- Housing needs are the single largest driver of residential moves

- Employment remains a key trigger, especially for interstate moves

- Family and lifestyle factors strongly influence relocation timing and destination

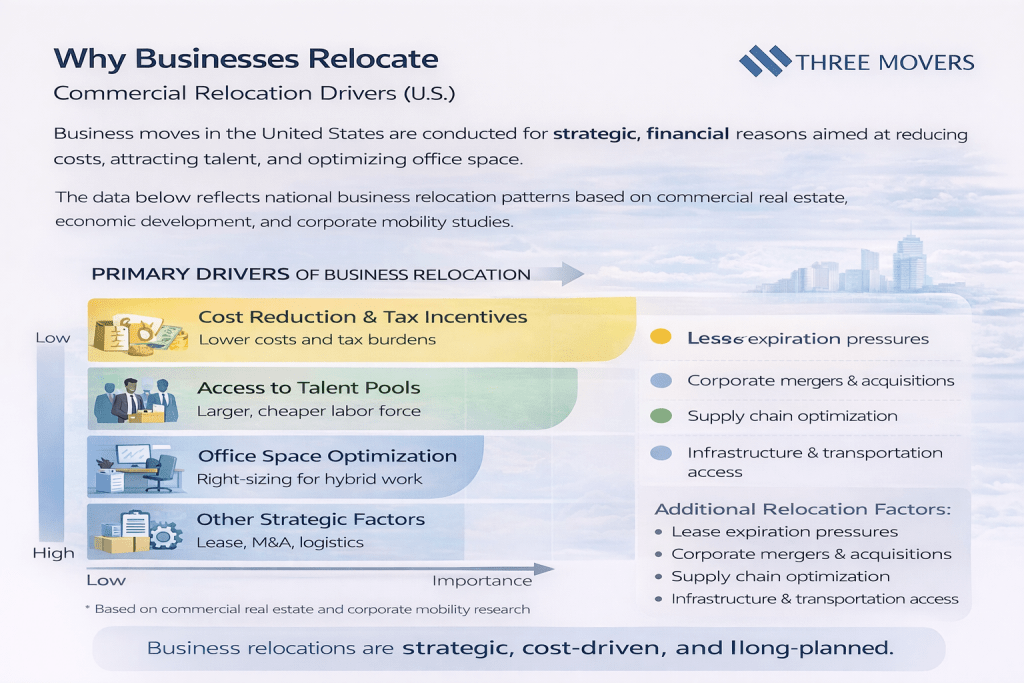

Why Businesses Relocate

Commercial Moving Drivers (U.S.)

Commercial and corporate relocations in the United States are driven by strategic business decisions rather than personal factors. While fewer in number than residential moves, business relocations tend to involve larger budgets, longer planning cycles, and broader economic impact.

The data below reflects national business relocation patterns based on commercial real estate, economic development, and corporate mobility studies.

Primary Drivers of Commercial Relocation

- Cost reduction and tax incentives

Businesses frequently relocate to reduce:- State and local tax burdens

- Real estate and operating costs

- Regulatory expenses

- Access to labor and talent pools

Companies move to regions offering:- Larger or more specialized workforces

- Lower labor costs

- Proximity to universities or industry clusters

- Office space optimization

Shifts in work models have made office size a major driver:- Office downsizing due to remote and hybrid work

- Consolidation of multiple locations

- Expansion into larger facilities during growth phases

Secondary Commercial Moving Factors

Additional factors influencing business relocations include:

- Lease expirations and renegotiations

- Corporate mergers and acquisitions

- Supply chain and logistics optimization

- Infrastructure and transportation access

Many commercial relocations are planned months or years in advance, making them less reactive to short-term economic conditions than residential moves.

Commercial Relocation Takeaway

- Business moves are strategic and cost-driven

- Interstate corporate relocations remain relatively rare

- When they occur, commercial moves tend to be high-value, complex projects

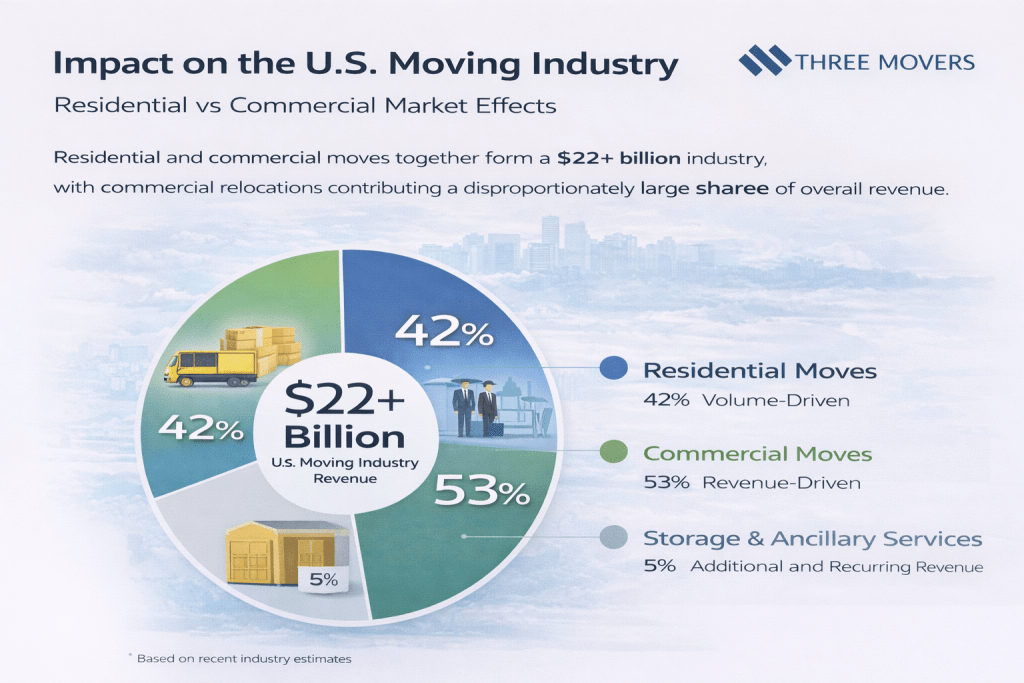

Impact on the U.S. Moving Industry

Residential vs Commercial Market Effects

Residential and commercial moves together shape the structure, revenue distribution, and operational demands of the U.S. moving industry. While residential moves account for the majority of transactions, commercial relocations play an outsized role in revenue concentration and logistical complexity.

The data below reflects publicly available industry estimates and workforce metrics.

Size of the U.S. Moving Industry

- The U.S. moving and storage industry generates approximately $22–23 billion in annual revenue

- The industry includes over 7,000 moving companies nationwide

- More than 120,000 workers are employed across residential, commercial, and storage services

Despite its scale, the industry remains highly fragmented, with most movers operating as small or mid-sized businesses.

Residential vs Commercial Revenue Dynamics

- Residential moves account for the largest share of total move volume

- Commercial and corporate relocations contribute a disproportionate share of industry revenue

- Commercial moves typically involve:

- Larger crews

- Specialized equipment

- Project management and coordination

- Higher per-move pricing

As a result, a single commercial relocation can generate the same revenue as multiple residential moves.

Operational Impact on Moving Companies

Residential and commercial moves place different demands on moving companies:

- Residential operations are volume-driven and highly seasonal

- Commercial operations are project-based, longer-term, and less seasonal

- Summer peak season requires:

- Temporary labor expansion

- Fleet scaling

- Tight scheduling windows

Many moving companies diversify across both segments to stabilize revenue throughout the year.

Industry Impact Takeaway

- Residential moves drive demand volume

- Commercial moves drive revenue density

- Companies serving both segments benefit from operational diversification

Key Takeaways

Residential vs Commercial Moving in the U.S.

Residential and commercial moving activity in the United States follows distinct patterns, but together they form a highly interconnected relocation ecosystem. The data below summarizes the most important differences and similarities based on national mobility and industry statistics.

Residential Moving Snapshot

- Accounts for the largest share of total moves by volume

- Most moves are local or intrastate

- Primary drivers include:

- Housing needs

- Employment changes

- Family-related factors

- Residential moving activity is highly seasonal, peaking during summer months

Commercial Moving Snapshot

- Represents a smaller number of total moves

- Moves are strategic, planned, and higher-cost

- Primary drivers include:

- Cost and tax optimization

- Access to labor markets

- Office space consolidation or expansion

- Commercial moves contribute a disproportionately large share of industry revenue

Industry-Level Insights

- The U.S. moving industry generates $22+ billion annually

- Residential moves drive demand volume

- Commercial moves drive revenue density

- Companies serving both segments benefit from operational and seasonal balance

Final Comparison Takeaway

- Residential moves are frequent and volume-driven

- Commercial moves are infrequent but revenue-intensive

- Together, they define how moving companies allocate labor, fleets, and pricing throughout the year