Published by Joe Webster

Last updated Jan, 24 2026

U.S. Office Relocation Volume

How Often Offices Move in the United States

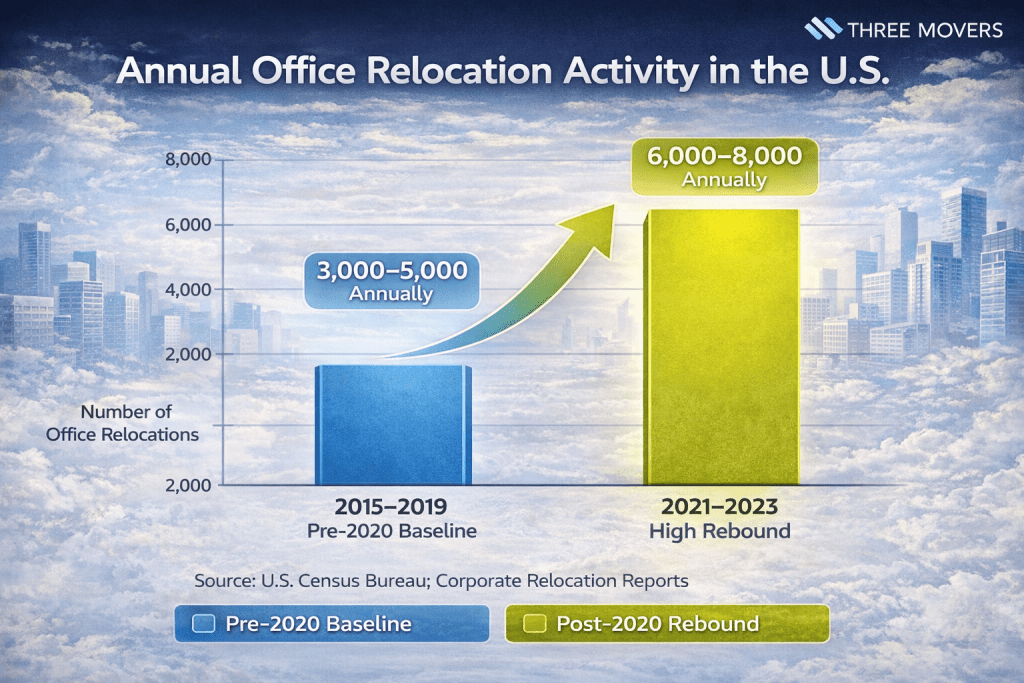

Office relocations are relatively infrequent compared to residential moves, but they represent some of the highest-impact and highest-cost relocations in the U.S. moving market. While most businesses remain in the same location for years, recent economic shifts have increased the pace of office moves nationwide.

Annual Office Relocation Activity (U.S.)

- Approximately 2–5% of U.S. businesses relocate offices in a given year

- This includes:

- Office expansions or downsizing moves

- Headquarters relocations

- Consolidation of multiple office locations

Although the percentage appears small, it translates into thousands of office relocations annually, many involving large workforces, complex logistics, and long planning cycles.

Interstate vs Local Office Moves

- The majority of office relocations occur within the same metro area or state

- Interstate office relocations remain rare, typically affecting:

- Corporate headquarters

- Executive offices

- Strategic business hubs

In 2021 alone, over 6,000 U.S. companies relocated across state lines, representing one of the highest recorded levels of interstate business movement in recent decades.

Post-2020 Office Relocation Trends

Office relocation activity declined sharply in 2020 as businesses paused expansion and froze real estate decisions. Since then:

- Office relocations have rebounded to pre-pandemic levels

- Corporate headquarters moves increased sharply between 2022 and 2023

- Downsizing and consolidation moves now account for a growing share of office relocations

Many post-2020 office moves are not growth-driven, but optimization-driven, reflecting changes in how companies use physical workspace.

Office Relocation Volume Takeaway

- Office moves are infrequent but operationally significant

- Most office relocations are local or regional

- Post-pandemic trends have increased downsizing and consolidation-driven moves

Why U.S. Companies Are Moving Offices

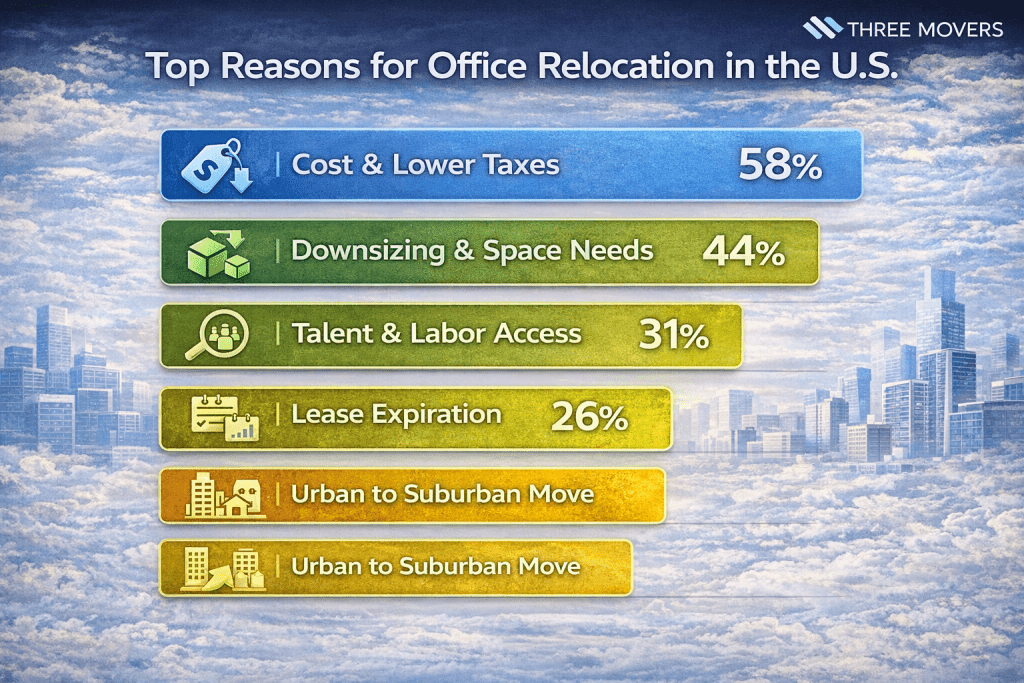

Office relocations in the U.S. are no longer driven by expansion alone. Post-pandemic workplace shifts, cost pressure, and workforce strategy have reshaped why companies move. Recent relocation data shows a clear pivot toward flexibility, efficiency, and talent access rather than prestige locations.

Key Office Relocation Drivers (U.S.)

- Cost reduction is the #1 trigger for office moves. Over 58% of U.S. office relocations cite rent, taxes, or operating costs as the primary reason for moving, according to corporate relocation and commercial real estate surveys.

- Hybrid and remote work adoption has directly influenced downsizing. Roughly 40–45% of relocating companies report moving to smaller office footprints than their previous locations.

- Talent access is now a relocation factor. Nearly 1 in 3 office moves are tied to proximity to labor pools rather than executive headquarters.

- Lease expirations drive timing. More than 60% of office relocations occur within 12 months of a major lease renewal decision.

- Urban to suburban shifts remain strong. Suburban office relocations account for over 50% of post-2021 office moves, driven by lower costs and commuter flexibility.

Structural Trend Insight

Unlike pre-2020 patterns, office moves today are strategic resets, not growth signals. Companies are optimizing for:

- Fewer square feet per employee

- Shorter lease commitments

- Flexible layouts instead of fixed departments

Average Cost of Office Moving in the U.S.

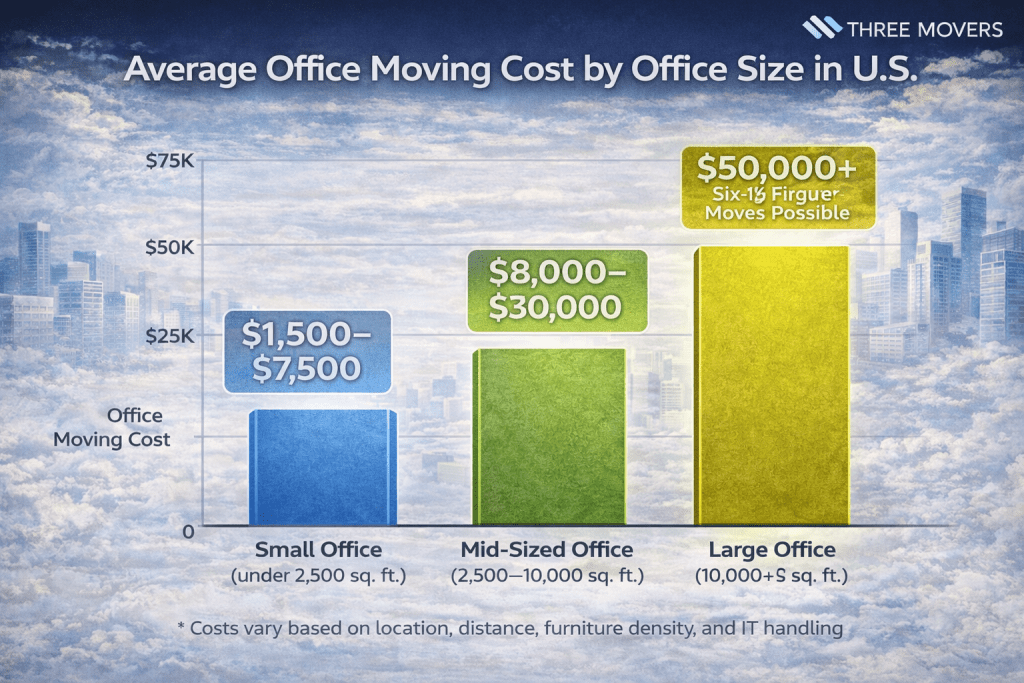

Office relocations are among the most expensive moving projects in the U.S. moving industry due to labor intensity, downtime risk, IT handling, and furniture logistics. Costs vary widely based on office size, distance, and complexity, but national benchmarks show clear patterns.

Average Office Moving Costs by Office Size

- Small offices (under 2,500 sq ft) typically spend between $1,500 and $7,500 for a local office move.

- Mid-sized offices (2,500–10,000 sq ft) commonly incur costs ranging from $8,000 to $30,000, depending on furniture density and IT requirements.

- Large offices (10,000+ sq ft) frequently exceed $50,000, with complex relocations reaching six-figure budgets for multi-floor or multi-location moves.

These figures include packing, loading, transportation, and basic setup but often exclude IT reconnection and construction-related delays.

Cost Per Square Foot Benchmarks

- The average office move costs between $0.75 and $2.50 per square foot

- Moves involving:

- Modular furniture

- Server rooms

- After-hours scheduling

tend to fall at the higher end of the range

Interstate office relocations can increase total costs by 30–70% compared to local moves due to freight logistics and coordination complexity.

Operational Cost Impact

Beyond direct moving expenses, businesses often face:

- Lost productivity during transition

- Temporary downtime for teams

- Overlapping lease costs during staggered moves

For this reason, office relocation costs are frequently evaluated as operational investments, not one-time expenses.

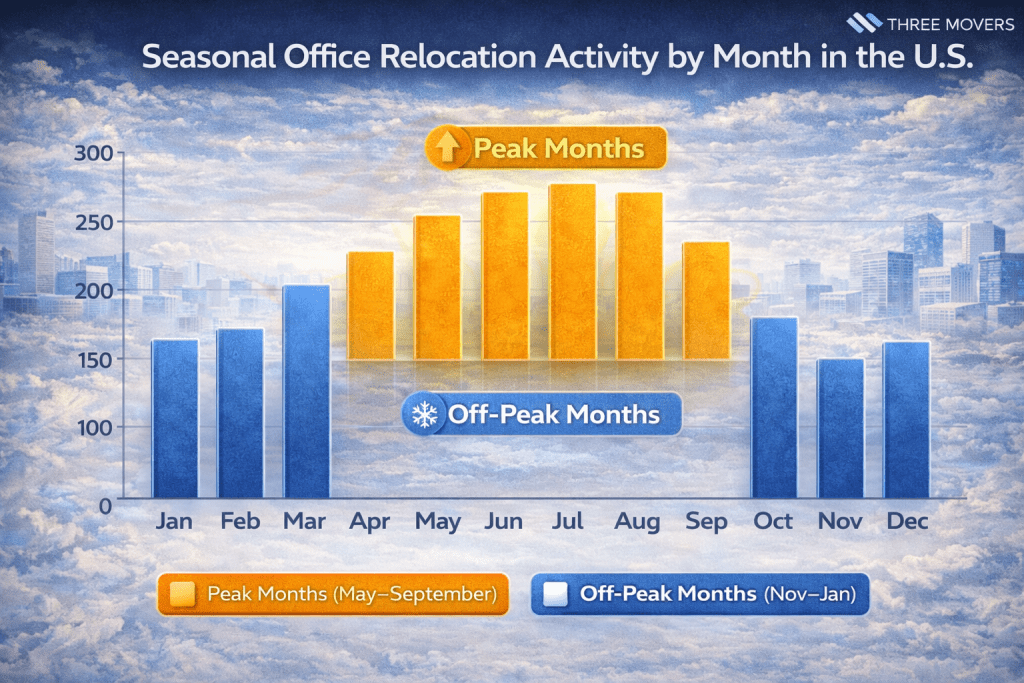

Seasonal Patterns in U.S. Office Relocations

Office relocations in the United States follow clear seasonal patterns, driven by lease cycles, fiscal planning, and the need to minimize business disruption. Unlike residential moves, office moves are carefully scheduled to avoid operational downtime.

Peak Months for Office Moving

- Late spring through early fall accounts for the majority of office relocations

- May through September consistently shows the highest concentration of office moves

- Summer relocations are preferred because:

- Employee availability is higher

- Weather conditions reduce logistical risk

- Lease expirations often align with mid-year cycles

Office moves are significantly less common during winter months, particularly between November and January, when business activity slows and holiday disruptions increase.

Fiscal & Lease-Driven Timing

- Many office relocations are tied directly to annual lease expirations

- Companies frequently schedule moves:

- At the end of a fiscal quarter

- Between major business cycles

- During planned operational resets

As a result, office relocations tend to cluster around Q2 and Q3, unlike residential moves which peak earlier in summer.

Operational Scheduling Insight

Office moves are often executed:

- After hours

- On weekends

- In phased stages

This approach reduces downtime but increases planning complexity, reinforcing why office relocations require longer lead times than residential moves.

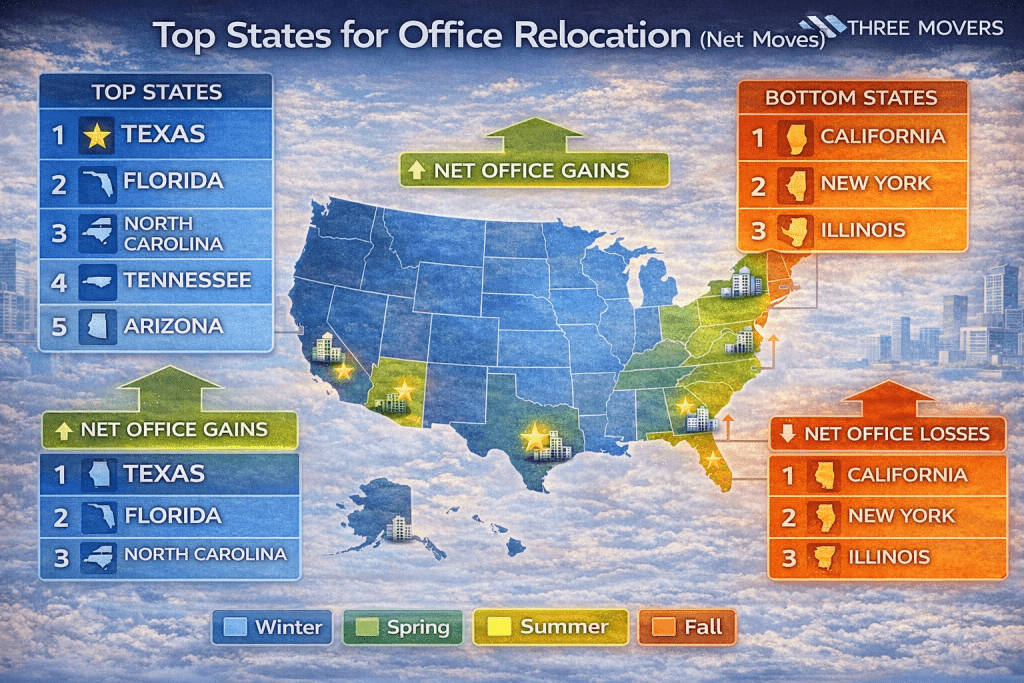

Regional Office Relocation Trends in the U.S.

Office relocations in the United States are not evenly distributed across regions. Over the past several years, office moves have increasingly reflected broader economic migration patterns, with companies shifting operations toward lower-cost, business-friendly states.

States Gaining Office Relocations

- Southern and Sun Belt states account for a growing share of inbound office moves

- Texas, Florida, North Carolina, Tennessee, and Arizona consistently rank among the top destinations for office relocations

- Key drivers of inbound office moves include:

- Lower commercial real estate costs

- Favorable tax environments

- Expanding labor markets

- Improved transportation infrastructure

Many office relocations into these states involve corporate headquarters, regional offices, or satellite hubs, rather than single-location moves.

States Losing Office Relocations

- High-cost coastal states continue to experience elevated outbound office movement

- California, New York, Illinois, and New Jersey see higher rates of office exits than inbound relocations

- Common drivers behind outbound office moves include:

- Rising lease and operating costs

- Remote workforce flexibility

- Corporate restructuring and consolidation

While these states still host large office markets, the net flow of office relocations has shifted toward more cost-efficient regions.

Metro & Suburban Shifts

- A significant share of office relocations now occur within metro regions, rather than across state lines

- Suburban office moves have increased as companies seek:

- Lower rents

- Easier commuting

- Flexible office layouts

This trend reflects a broader decentralization of office locations rather than a reduction in office activity.

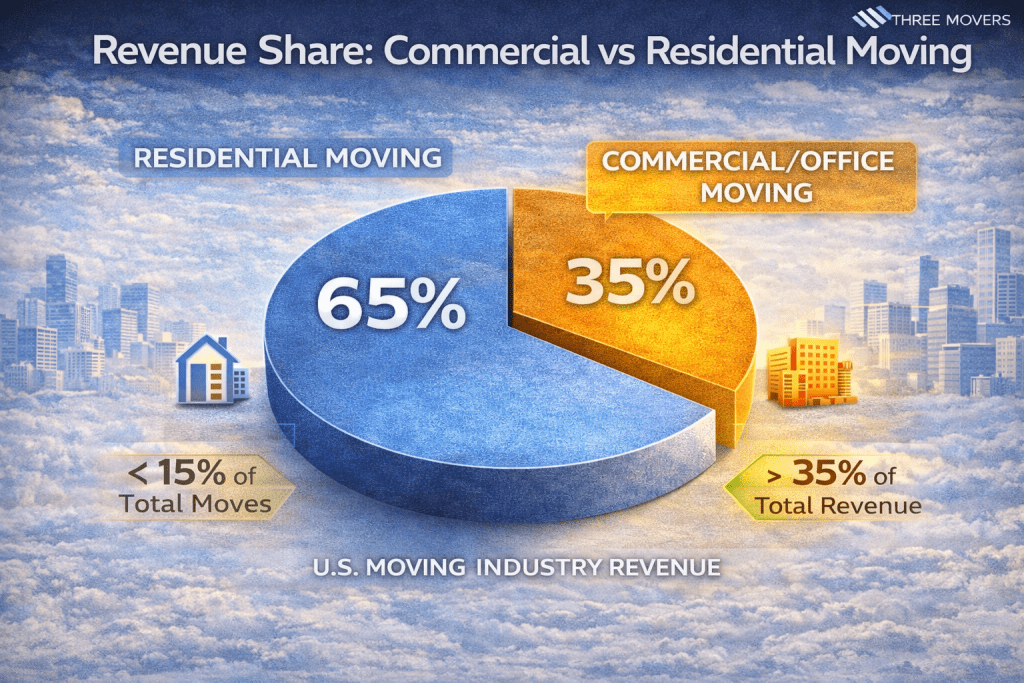

Impact of Office Relocations on the Commercial Moving Industry

Office relocations represent a small share of total moving volume but generate a disproportionately large share of revenue for the U.S. moving industry. These moves involve higher labor requirements, longer planning cycles, and greater operational risk compared to residential relocations.

Commercial vs Residential Moving Value

- Office relocations account for less than 15% of total move volume

- Despite this, commercial and office moves contribute over 35% of total moving industry revenue

- Office moves typically involve:

- Multiple crews

- Specialized equipment handling

- IT and infrastructure coordination

This makes office relocation projects among the highest-value contracts for professional movers.

Revenue Characteristics of Office Moves

- Office relocations generate 2–4× higher revenue per project than residential moves

- Long-distance or multi-location office moves frequently exceed:

- $50,000 per project

- $100,000+ for enterprise-scale relocations

Because downtime directly affects business operations, companies prioritize experienced commercial movers, reinforcing pricing stability in this segment.

Post-Pandemic Industry Recovery

- Office moving activity declined sharply in 2020

- Since 2022:

- Commercial moving demand has returned to pre-pandemic levels

- Corporate relocation budgets have increased year-over-year

- Hybrid work did not reduce industry demand, but shifted project scope toward:

- Downsizing moves

- Consolidation projects

- Office reconfiguration relocations

Industry Insight

Office relocations continue to anchor the commercial moving sector due to their high revenue density, even as total office square footage declines nationwide.

Key Takeaways from U.S. Office Moving & Relocation Data

Office relocations in the United States represent a low-frequency but high-impact segment of the moving industry. While fewer businesses relocate offices compared to households, the operational and financial implications are significantly larger.

Key Office Relocation Insights

- Office relocations affect only a small percentage of U.S. businesses annually, but involve complex planning and higher costs.

- Most office moves are local or regional, rather than interstate.

- Cost reduction and space optimization are now the dominant drivers of office relocations.

- Remote and hybrid work models have increased office downsizing moves, rather than eliminating relocations altogether.

- Office relocations follow predictable seasonal patterns, with most activity occurring between late spring and early fall.

- Southern and Sun Belt states continue to attract a growing share of office relocations, reflecting broader business migration trends.

- Commercial office moves generate disproportionately high revenue for moving companies compared to residential relocations.